Life Insurance in and around Wilson

State Farm can help insure you and your loved ones

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

It's Never Too Soon For Life Insurance

People sign up for life insurance for many different reasons, but the goal is normally the same: to ensure the financial future for your partner after you're gone.

State Farm can help insure you and your loved ones

Now is the right time to think about life insurance

State Farm Can Help You Rest Easy

Service like this is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If tragedy strikes, Erika Thomas is committed to helping process the death benefit with care and consideration. State Farm has you and your loved ones covered.

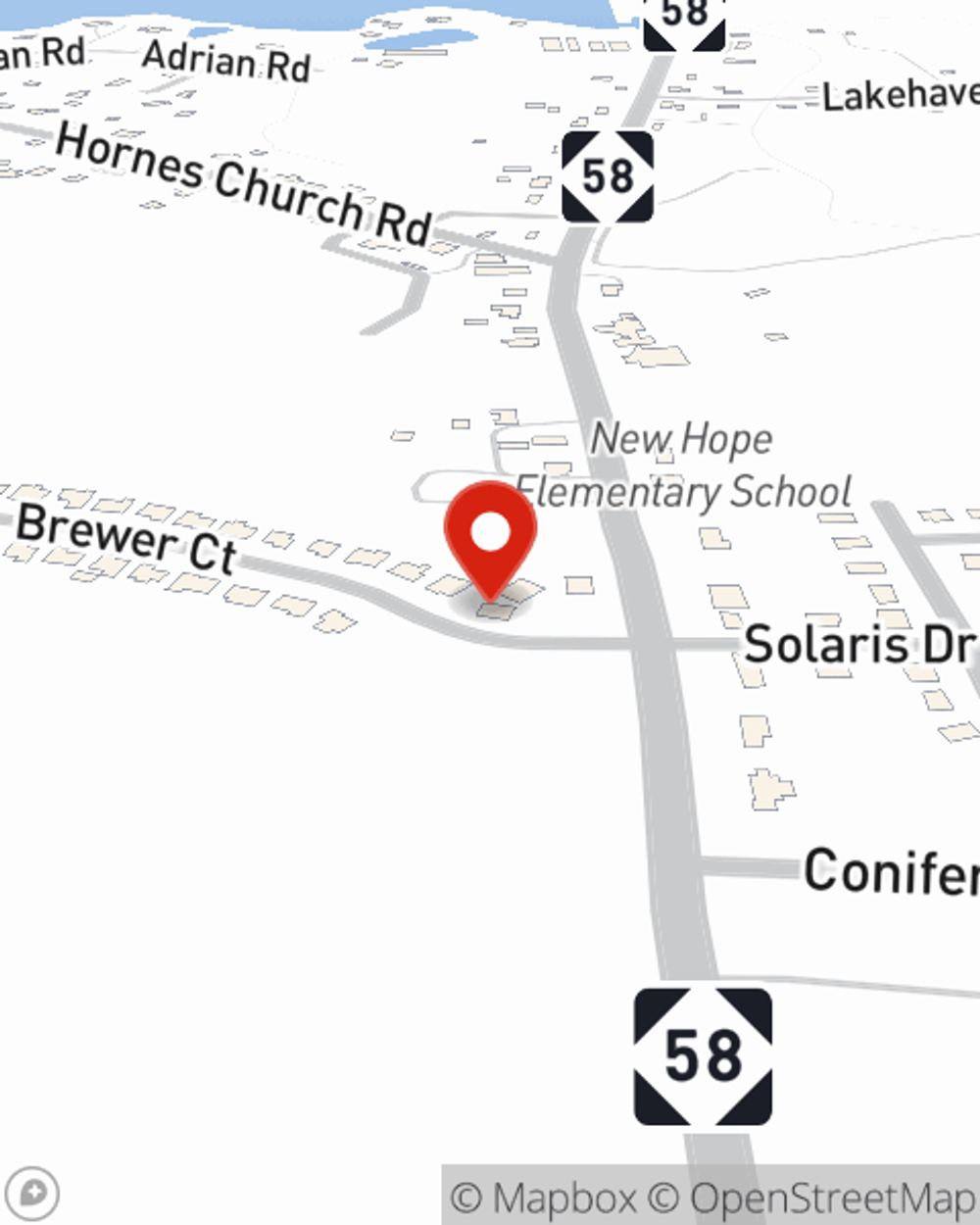

To discover what State Farm can do for you, contact Erika Thomas's office today!

Have More Questions About Life Insurance?

Call Erika at (252) 237-1223 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Life insurance basics

Life insurance basics

Understanding life insurance, what it is, how it works and the different types can help you decide which life insurance policy is right for you.

Erika Thomas

State Farm® Insurance AgentSimple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Life insurance basics

Life insurance basics

Understanding life insurance, what it is, how it works and the different types can help you decide which life insurance policy is right for you.